The CPA is on the November ballot and it needs your support - VOTE YES!

The CPA is a Massachusetts program which allows communities to create a local fund dedicated to open/recreation spaces, historic resources, and housing. It will appear on Springfield's ballot on November 8, and we hope you vote Yes!

To invest in our city!

CPA projects - while critical - rarely get funded from the normal municipal budgeting process. That's because our tax dollars need to fund crucial services such as our schools, our police and fire departments, and important infrastructure projects like our roads. But CPA projects matter too! They support the types of physical and aesthetic characteristics that people look for when choosing a strong community in which to live - they make the community more vital and more attractive.

By voting YES for the CPA, you will ensure that these projects no longer fall by the wayside. CPA projects will help make Springfield more desirable to prospective residents and businesses which, in the long run, will benefit all of its citizens. Passage of the CPA measure can help ensure that more homeowners are drawn to our great city, stay in our city, and thrive in our city!

The CPA fund is created via a small surcharge (1.5%) on your property tax bill. The first $100,000 of your valuation is exempted from the CPA. For the average homeowner in Springfield, this comes to about $10 per year, which amounts to $2.50 per quarterly bill, or just 83 cents per month.

We have created a calculator which will tell you, based on 2016 tax rates, how much the CPA would add to your bill.

If you don't know your valuation, you can check it on the Springfield Assessor's Website.

Additionally, the state matches the money that local communities put in with revenue derived from existing filing fees at the Registry of Deeds. The matching rate in 2015 was about 25%, although in the past it has been as high as 100% - dollar for dollar matching!.

CPA funds can be used only for open/recreation spaces, historic resources, and housing. A minimum of 10% of CPA funds must be allocated annually for each of those categories. The remaining 70% can be allocated among the categories in any percentage.

A committee called the Community Preservation Committee (CPC) is made up of a member from each of the following organizations:

- Springfield Parks Commission

- Springfield Historical Commission

- Springfield Planning Board

- Springfield Housing Authority

- Springfield Conservation Commission

Additionally, should the CPA pass, when drawing up the final legislation, the Springfield City Council may create up to four additional "at-large" members of the CPC, to ensure that all corners of our city are represented.

Proposals are then submitted to the CPC, which votes on them, and then submits them to the Springfield City Council for final approval.

These proposals can be submitted by both municipal departments and private organizations. The only stipulation is that the projects must be used to advance a public purpose.

The CPA fund cannot be transfered to the general budget. It cannot be used to pay for wage increases to city employees, or to put more people on the city payroll. The fund can only be used for concrete projects within those three areas.

The projects funded by the CPA are selected by the CPA committee, not the existing city administration. This gives ordinary residents more of a say in the process. Instead of long-time department heads setting the agenda behind closed doors, the Community Preservation Committee solicits feedback from the public in open meetings. The City Council must approve all expenditures as a final check and balance.

Yes, the ordinance provides exemptions for owner-occupants who would normally qualify for low or moderate income senior housing. Such residents would need to apply annually to receive this exemption.

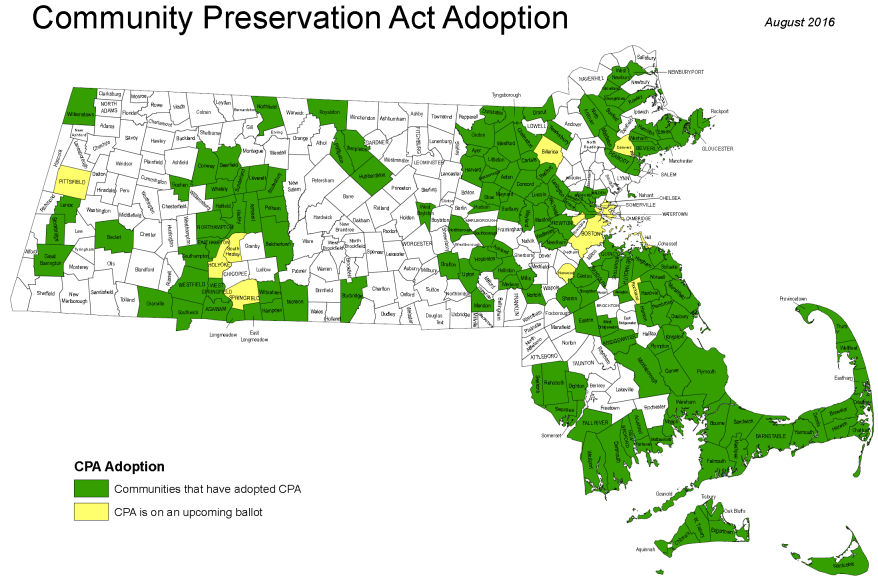

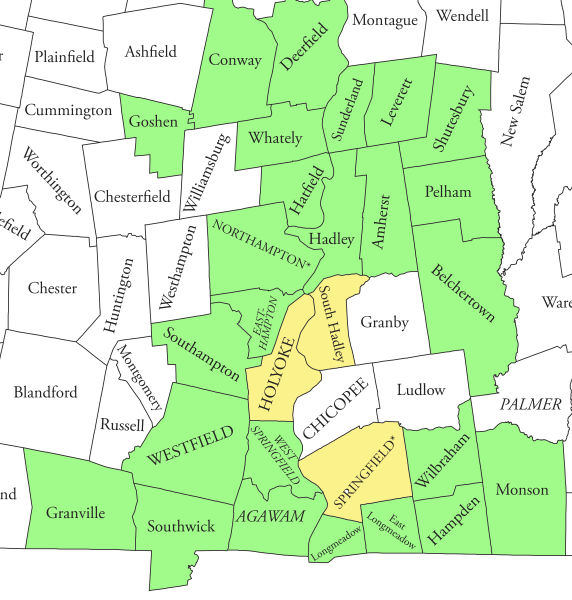

The CPA has been around since the year 2000, and 161 communities in the state have voted to adopt it so far, with nine more considering it this year.

Closer to home, most cities and towns in our region have adopted it, including Longmeadow, East Longmeadow, Hampden, Wilbraham, Agawam, West Springfield, Westfield, and Southwick.

You can contact us by We will be glad to answer any further questions you might have.

Additionally, you may visit the website of a statewide advocacy group called the Community Preservation Coalition. They have a complete list of projects achieved via the Community Preservation Act across the state.

We are Springfield CPAdvocacy - a registered political committee that is advocating for the passage of the Community Preservation Act in Springfield.

Our President is Robert McCarroll, of 96 Elliott Street in Springfield. He has been involved in Historic Preservation in the city for over four decades, most recently serving as a member of the Springfield Historical Commission.

Our Treasurer is Ralph Slate, of 270 Longhill Street in Springfield. He is a lifelong history buff, and served as Chairperson of the Springfield Historical Commission for eight years.

We have several other volunteers from across the city, all citizens who are interested in making our city a better place.

Open Space/Recreation

Open Space/Recreation

Historic Preservation

Historic Preservation

Housing

Housing